Understanding Dilapidations Provision

Dilapidations provision is a crucial aspect of property leasing and management, particularly within the commercial sectors. As you navigate through the complexities of property leasing, understanding the financial implications tied to dilapidations can empower you, ensuring you are fully prepared for end-of-lease responsibilities.

What is Dilapidations Provision?

Dilapidations provision refers to the setting aside of funds by the tenant to cover potential costs for repairs or reinstatement of a property at the end of a lease, as required under the terms of the lease agreement. This financial measure helps manage the tenant's liability, and it ensures less financial strain when the lease concludes.

How to Calculate Dilapidations Provision

To accurately estimate the potential costs involved in dilapidations, several factors should be considered:

- The current state of the property versus the state at lease commencement.

- The terms and conditions specified in the lease agreement.

- Anticipated life expectancy of the building elements.

- Legal costs that might arise during the settlement of claims.

These factors are integral to setting a realistic provision, balancing the tenant's financial planning and compliance with the lease terms.

Impact of Dilapidations on Business Strategy

Having a robust dilapidations provision strategy can significantly impact your business, offering benefits such as:

- Financial Planning: It helps in smoothing financial expenditure over the lease period rather than facing a substantial one-off expense.

- Risk Mitigation: Adequately preparing for end-of-lease expenses reduces the risk of disputes with landlords over property conditions.

- Lease Negotiations: A clear understanding and setting aside of dilapidations funds can be a strong negotiation point in lease agreements.

Ultimately, a well-managed dilapidations provision not only aids in compliance with lease terms but also supports fiscal responsibility and strategic business planning.

Seeking Expert Advice

To navigate the complexities surrounding dilapidations provisions effectively, it is advisable to seek expert advice. Professional surveyors specialised in dilapidations can provide detailed assessments and forecasts that guide your financial planning and legal compliance throughout your leasing period. Contact us today to recieve a dilapidatons report that extimates the liability that you could face at the end of a commercial tenancy

Understanding and implementing a sound dilapidations provision strategy enhances your financial control and promotes a more professional relationship between landlord and tenant. Doing so not only aligns with sound business practices but also positions your business for smoother transitions at the end of lease terms.

Testimonials

AAL chartered surveyors

2025-04-13 08:53:52 British local time

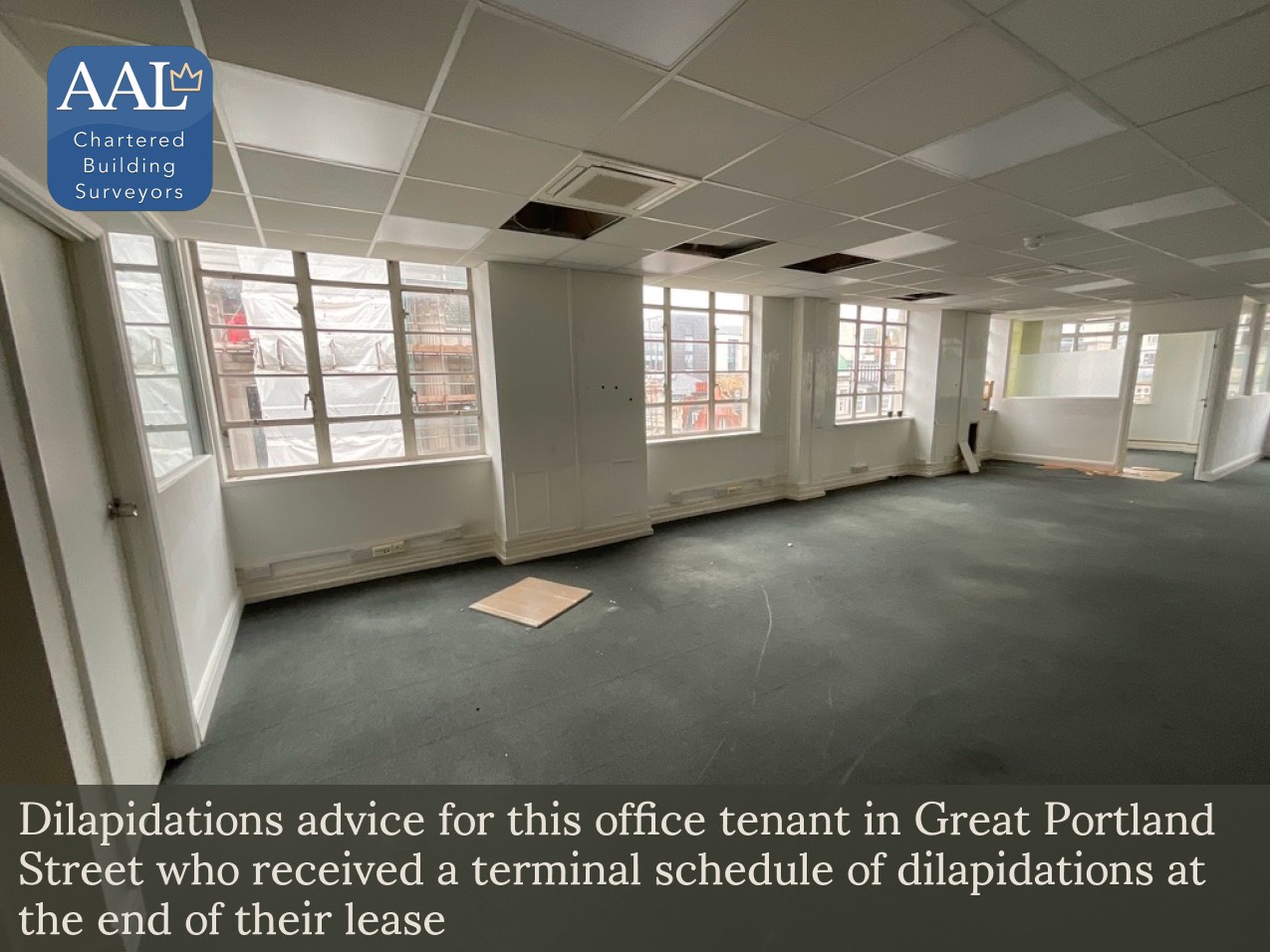

When acting for a tenant in a dilapidations matter such as the case on Great Portland Street, the following methodology is adopted to ensure the client is informed and appropriately represented: - Le... Read more

When acting for a tenant in a dilapidations matter such as the case on Great Portland Street, the following methodology is adopted to ensure the client is informed and appropriately represented: - Lease documents are reviewed to identify relevant dilapidations clauses and clarify the tenant’s obligations. - The schedule of dilapidations is examined in detail, focusing on listed items and any time-based requirements. - A site inspection is undertaken to assess the property’s current condition and check for discrepancies or errors in the schedule. - Photographic and documentary evidence is compiled to support observations made during inspection. - The condition of the property is compared against the schedule to identify any inconsistencies or inaccurate claims. - Remedial costs are assessed using prevailing market rates. - The client is consulted to explain findings and discuss any areas of potential dispute. - Legal advice is sought where necessary to clarify lease interpretation or potential defences. - A report is produced summarising the findings, discrepancies, estimated costs, and possible negotiation strategies. - Negotiations are undertaken with the landlord or their representatives to present findings and seek appropriate amendments.

AAL chartered surveyors

2025-04-13 08:53:35 British local time

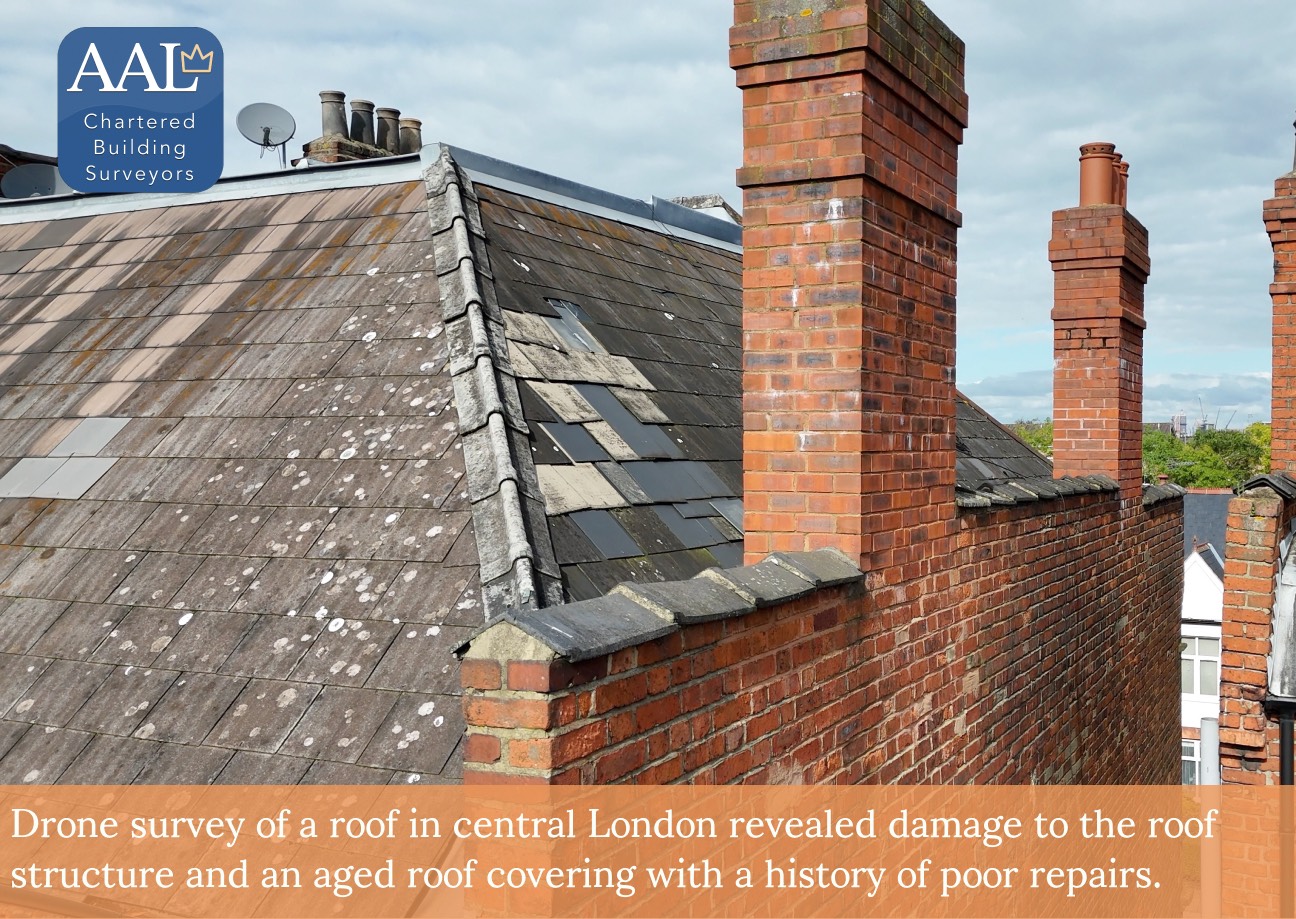

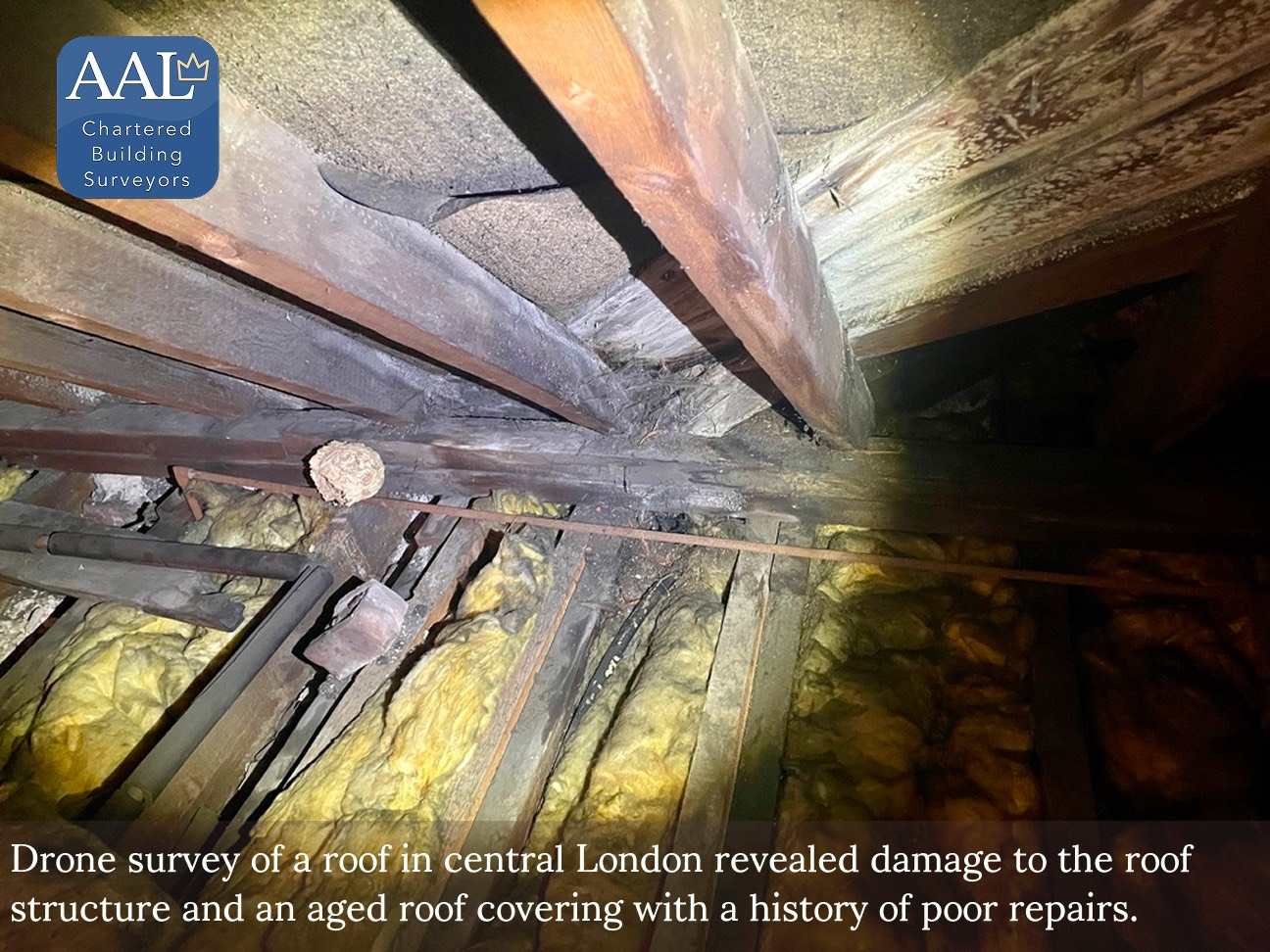

At AAL Surveyors, our commitment to providing a thorough and insightful assessment of your property is second to none. During a recent drone roof survey in central London, we identified an aged fibre ... Read more

At AAL Surveyors, our commitment to providing a thorough and insightful assessment of your property is second to none. During a recent drone roof survey in central London, we identified an aged fibre cement roof covering, complemented by a zinc flat roof section. Unfortunately, the fibre cement slates were observed to be in a deteriorating state, with several low-quality repairs evident. Additionally, we noted early stages of biodegradation in the roof timbers, which could potentially escalate if not addressed in a timely manner. Our detailed report offers a clear understanding of these findings and presents strategic recommendations for maintenance and repairs. Utilising our cutting-edge drone technology allows us to efficiently conduct these surveys with minimal disturbance. Rest assured, our team is here to provide expert advice and support, ensuring your property's longevity and safety.

AAL chartered surveyors

2025-04-13 05:27:19 British local time

Our recent drone-assisted roof survey in central London has identified some key areas of concern that may require further attention. Utilising advanced high-resolution aerial imaging technology, we we... Read more

Our recent drone-assisted roof survey in central London has identified some key areas of concern that may require further attention. Utilising advanced high-resolution aerial imaging technology, we were able to thoroughly examine this pitched roof without the need for scaffold or rope access, ensuring both efficiency and minimal disruption. Upon close inspection, we observed that the fibre cement slates currently covering the roof have begun to show signs of ageing. Weathering, surface delamination, and partial displacement were prevalent, with some sections suffering from poorly executed repairs using mismatched materials. Additionally, the ridge and verge detailing appear to be composed of fibre cement, which we suspect may contain asbestos. Inside the loft space, the visible timbers have begun to suffer from early-stage biodegradation, indicated by darkening, staining, and some surface softness. These findings suggest that there might be elevated moisture levels, potentially due to water ingress from the roof's defects or insufficient ventilation. Given these observations, we recommend a more invasive investigation to fully assess the extent of timber deterioration and consider any potential structural implications. Addressing these issues promptly can help protect the integrity of the building and ensure the safety of its occupants. Our team is fully equipped to assist with detailed evaluations and provide expert solutions tailored to your specific needs. Please do not hesitate to contact us for a consultation or further information.

AAL chartered surveyors

2025-04-13 05:17:22 British local time

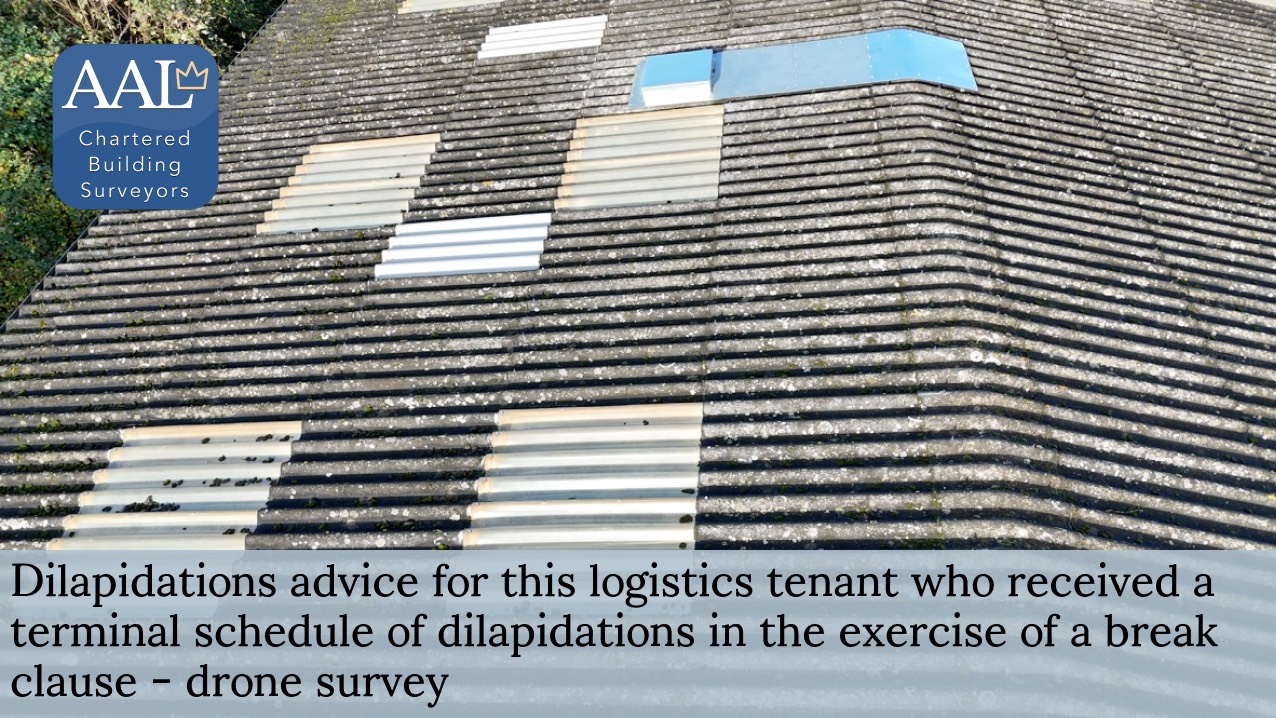

The utilisation of drone technology in the survey of the warehouse unit in South East London represents an innovative approach to modern building surveying, particularly for the inspection of areas ot... Read more

The utilisation of drone technology in the survey of the warehouse unit in South East London represents an innovative approach to modern building surveying, particularly for the inspection of areas otherwise challenging to access, such as the roof. At our RICS-accredited firm, we embrace this methodology to ensure a comprehensive and accurate inspection of the property's current state. The aerial survey conducted provided high-resolution imagery that was integral in documenting the exact condition of the roof covering, penetrations, and alterations. Such comprehensive techniques are crucial, for the management and defense of dilapidations claims. By comparing these drone-captured images with the details listed in the schedule of dilapidations, we were able to identify any inconsistencies or discrepancies effectively. This approach is highly beneficial in formulating a robust defence strategy for our clients, ensuring that any claims of damages are clearly substantiated by clear, empirical evidence. In conclusion, the deployment of drone technology in the roof inspection of the warehouse not only enhanced the accuracy of our findings but also significantly contributed to a strategic approach in handling the dilapidations claim. This method exemplifies our commitment to employing cutting-edge technology to deliver exceptional service and reliable advice to our clients.

AAL chartered surveyors

2025-04-13 05:11:43 British local time

We recently conducted a Reinstatement Cost Assessment (RCA) for this listed building in central London. Undertaking such an excercise, requires a detailed understanding of both historical construction... Read more

We recently conducted a Reinstatement Cost Assessment (RCA) for this listed building in central London. Undertaking such an excercise, requires a detailed understanding of both historical construction methods and the implications for insurance reinstatement values. The building incorporated specialist features including stained glass windows, rare stone cladding with decorative carvings, bespoke curved stone stairways, hand-painted murals, and ornamental stucco plasterwork, each of these elements require special consideration to understand their impact on the RCA bottom line figure. - Stained Glass and Domes: These elements require skilled artisans familiar with traditional techniques. The cost of replication varies depending on the complexity of the design and the availability of specialists. - Rare Stone Cladding with Decorative Carvings: The sourcing of rare stone and the craftsmanship required for intricate detailing can involve significant costs, particularly where specialist skills are needed for precise replication to meet listed building requirements. - Curved Bespoke Stone Stairways: These features often necessitate custom stone masonry, a skillset that is becoming increasingly rare, contributing to elevated labour costs. - Hand-Painted Historic Murals: The restoration of original murals or their replication requires artists trained in historical techniques, with additional conservation measures often necessary. - Ornamental Stucco Plasterwork: Restoring or recreating decorative plasterwork requires specialists familiar with traditional methods to ensure accuracy and durability. Accurate reinstatement valuations are essential to mitigate the risk of financial shortfalls in the event of damage or loss. A comprehensive RCA, undertaken in accordance with RICS guidance, ensures that insurance coverage reflects both the complexity and specialist nature of the construction. Our team is experienced in assessing both modern and historic buildings, ensuring valuations are accurate and aligned with the building’s unique characteristics. If an assessment is required, contact us to arrange a consultation.

AAL chartered surveyors

2025-04-12 16:34:35 British local time

Reinstatement Cost Assessment for Insurance at a Prestigious Central London Listed Building for an Academic Institution Objective The primary objective of this commission by AAL Surveyors www.ayling... Read more

Reinstatement Cost Assessment for Insurance at a Prestigious Central London Listed Building for an Academic Institution Objective The primary objective of this commission by AAL Surveyors www.aylingassociates.com was to determine the reinstatement cost of a prestigious listed building situated in central London, currently utilised by an esteemed academic institution. This assessment is crucial in providing the institution with a precise estimation of potential rebuilding costs should a catastrophic event necessitate a complete structural restoration. Importance of Accurate Insurance Valuation It is paramount for our clients to ensure their properties are accurately covered for their full reinstatement value to guard against the financial pitfalls of underinsurance. This is particularly vital for listed buildings in prestigious locations such as central London, where rebuilding costs can be significantly higher due to the specialized nature of the structures and the materials required. Our Approach At AAL Surveyors, we bring a deep understanding of the complexities involved with listed buildings and the specific requirements tied to their restoration. Leveraging the latest RICS published cost tables, combined with the seasoned expertise of our chartered surveyors, we deliver precise and reliable reinstatement cost assessments. Our comprehensive approach encompasses a detailed analysis of the building’s current condition, historical significance, construction methodologies, and the bespoke materials needed to meet the stringent regulations governing listed buildings. Client Assurance Clients can rest assured that with AAL Surveyors, their reinstatement valuations are accurately calculated, reflecting the true cost of rebuilding while complying with all regulatory requirements and preserving the architectural integrity of the property. Our assessments not only provide peace of mind but also ensure that our client's investments are suitably protected with appropriate insurance cover. By choosing AAL Surveyors for reinstatement cost assessments, you can benefit from our tailored expertise, which safeguards their legacy and financial stability for future generations.

AAL chartered surveyors

2025-04-12 16:30:28 British local time

When navigating the complexities of a break clause and facing a terminal schedule of dilapidations, it's paramount to approach the situation with clarity and strategic foresight. Here's how we can ass... Read more

When navigating the complexities of a break clause and facing a terminal schedule of dilapidations, it's paramount to approach the situation with clarity and strategic foresight. Here's how we can assist: Understanding Your Break Clause: The first step is a thorough examination of your lease's break clause to understand your rights, obligations, and any conditionalities attached. Break clauses can be highly specific, and even minor oversights can impact your ability to exercise them effectively. We provide expert lease analysis to ensure that you are fully aware of the conditions you must meet to successfully enact the break clause. Strategic Advice on Dilapidations Claims: Upon receiving a terminal schedule of dilapidations, it's crucial to assess the extent and validity of the claimed breaches against the lease requirements. We guide our clients through each item listed in the schedule, advising on the landlord's likely entitlements and the reasonableness of the claims. This includes assessing whether repairs, reinstatements, or other works are genuinely necessary to fulfill your lease obligations. Negotiating With Your Landlord: Effective negotiation is key to managing dilapidations claims. Our team has extensive experience in negotiating dilapidations matters, ensuring that your interests are robustly represented. We aim to reach a settlement that minimizes your liabilities while complying with your lease terms, helping you to avoid the potential cost and disruption of legal disputes. Preparation for Dilapidations Works: If works are necessary to comply with the dilapidations schedule, we offer comprehensive support in planning and executing these works. Our expert surveyors can guide you through the entire process, from selecting contractors to overseeing the completion of works, ensuring that everything is conducted efficiently and to the required standards. By providing tailored advice and proactive support, we help our clients smoothly navigate the complexities of break clauses and dilapidations, safeguarding your interests and facilitating a seamless transition at the end of your lease.

AAL chartered surveyors

2025-04-12 16:29:05 British local time

Reinstatement Cost Assessment for Insurance Purposes for an historic building Prestigious Central London Listed Building for An Academic Institution At www.aylingassociates.com, providing a Reinstat... Read more

Reinstatement Cost Assessment for Insurance Purposes for an historic building Prestigious Central London Listed Building for An Academic Institution At www.aylingassociates.com, providing a Reinstatement Cost Assessment for a prestigious listed building, particularly one utilised by an academic institution in the heart of London, requires an approach with a respect for the property's architectural and historical significance. Our methodology, complies fully with RICS guidelines, ensuring precision and reliability throughout the assessment process. Methodology Overview 1. Desktop Study: Initially, we conduct a thorough desktop study. This step involves reviewing existing documentation, architectural plans, and historical records for the building to understand its unique characteristics, heritage, and the context of its construction. This stage also includes examining any legal or regulatory implications of its listed status which could influence the reinstatement valuation. 2. On-site Inspection: Following the desktop review, our chartered surveyors perform a detailed on-site inspection. Key activities during this phase include: - Accurately measuring the building to ensure our costings are based on actual dimensions. - Carefully identifying and recording the types of construction materials and building techniques used. - Assessing the condition and extent of any alterations or additions made by the client, which might not only affect the building’s value but also its insurance requirements. 3. Cost Estimation: After gathering all necessary data, our team returns to the office to begin the task of translating these data into an accurate reinstatement cost. This includes calculating the costs involved in rebuilding the structure to its former condition in the event of significant damage or loss, in accordance with the requirements governing listed buildings. 4. Benchmarking: We benchmark our projected costs against similar real-world projects. This involves comparing our findings with recent, comparable rebuilds or restorations of listed buildings, ensuring our clients receive a realistic and market-reflective reinstatement valuation. Our approach not only satisfies insurance requisites but also provides our clients with a clear and comprehensive understanding of the potential costs involved in reinstating their invaluable assets to their historic and rightful state.

AAL chartered surveyors

2025-04-12 16:20:05 British local time

When faced with a terminal schedule of dilapidations as a tenant, especially during the exercise of a break clause, it's crucial to navigate the process with thoroughness. Dilapidations can often be a... Read more

When faced with a terminal schedule of dilapidations as a tenant, especially during the exercise of a break clause, it's crucial to navigate the process with thoroughness. Dilapidations can often be a complex field, with potential pitfalls and significant financial implications. Upon receiving a terminal schedule of dilapidations, the initial step should be to seek professional advice to understand fully the claims being made and the obligations stipulated in your lease agreement. Our team at AAL Surveyors collaborates closely with experienced solicitors and liaises effectively with landlords' surveyors to ensure your position is robustly represented and protected. A vital component of this process is the negotiation and finalisation of a release letter. This document is essential as it confirms the agreement between the tenant and the landlord concerning the condition of the property at the lease's end. Precision in the language used is crucial to reflect accurately the deal the tenant expects and to secure in terms favorable for both parties. In this recent engagement, our approach involved working alongside solicitors and the landlord's surveyor. Our aim was to negotiate a release letter that not only aligned with our client's expectations but also facilitated a smooth and unambiguous final agreement. Our efforts ensured that the final engrossed document accurately embodied the agreed settlement terms, providing our client with reassurance and clarity as they moved forward. For tenants, the benefits of such diligent professional support are clear. Not only does it help in possibly reducing the financial burden associated with dilapidations claims, but it also aids in ensuring a clean and undisputed exit from the property. This sets a solid foundation for future lease negotiations and maintains a good professional relationship with the landlord. Our team offers technical and legal insight in the handling of tenant dilapidations, with a focus on achieving outcomes that align with our clients’ lease obligations and commercial objectives.

AAL chartered surveyors

2025-04-12 16:17:20 British local time

Dilapidations Advice for Warehouse Unit in South East London: Methodology We are dedicated to providing our clients with thorough and strategic dilapidations advice ensuring that tenant obligations a... Read more

Dilapidations Advice for Warehouse Unit in South East London: Methodology We are dedicated to providing our clients with thorough and strategic dilapidations advice ensuring that tenant obligations and liabilities are clearly understood and managed effectively. Our approach typically involves the following steps: 1. Lease Documentation Review Initially we review the lease documents to pinpoint the relevant dilapidations clauses and obligations relevant to the claim. This step is crucial to understanding the legal framework and responsibilities before any further assessment is made. 2. Schedule of Dilapidations Review We then obtain and carefully analyse the schedule of dilapidations paying close attention to the listed items and any related timelines. This document is fundamental in setting the scope of our inspection and subsequent actions. 3 Site Inspection Our chartered surveyors conduct a detailed onsite inspection of the property to ascertain its current condition. This involves a thorough examination to spot any discrepancies with the schedule and to understand the context of each noted issue. 4. Evidence Compilation We gather substantial photographic and documentary evidence during our inspection to substantiate our findings. The evidence that we gather is essential for accurately presenting the condition of the property and supporting any discussions or negotiations. 5. Condition Comparison Our team compares the condition of the property as observed onsite with the details recorded in the schedule of dilapidations. We note any inconsistencies or erroneously included items which might affect the tenant liabilities. 6. Cost Assessment We assess the scope and potential costs associated with the remedial works detailed in the schedule, always referencing current market rates to ensure fairness and accuracy. 7. Tenant Consultation Subsequent to our assessment we engage directly with you the tenant to discuss our findings comprehensively. This includes a clarification of your lease obligations the physical condition findings and any potential areas for dispute or negotiation. 8. Legal Consultation If necessary we consult with legal advisers to dissect complex lease provisions or to discuss potential defence strategies. This is to ensure that every legal aspect is meticulously considered and upheld 9. Negotiation and Liaison Finally we represent you in discussions with the landlord or their appointed agent. Our goal here is to negotiate any changes to the schedule of dilapidations based on our findings aiming to minimise your potential liabilities and ensure a fair conclusion.

AAL chartered surveyors

2025-04-12 15:20:07 British local time

At our recent commercial due diligence survey of an industrial unit in East London the findings of our report led to significant financial advantages for our client. We identified several issues which... Read more

At our recent commercial due diligence survey of an industrial unit in East London the findings of our report led to significant financial advantages for our client. We identified several issues which equated to potential cost savings of approximately £150,000. These findings played a pivotal role in empowering our client during lease negotiations. With the evidence provided by us, our client was able to engage confidently and effectively in discussions with the landlord. This not only facilitated a reconsideration of the lease terms but also allowed the client to negotiate a reduction in rental values and improvements to other lease-related conditions. Our proactive approach in highlighting these issues underscores our commitment to adding tangible value to our clients' investment decisions. By ensuring that all factors are thoroughly vetted, we position our clients in a place of strength, enabling them to make informed and advantageous decisions and negotiations.

AAL chartered surveyors

2025-04-12 15:11:58 British local time

At our recent commercial due diligence survey of an industrial unit in East London, we utilised drone technology to conduct a detailed inspection of areas otherwise impossible to access, such as the r... Read more

At our recent commercial due diligence survey of an industrial unit in East London, we utilised drone technology to conduct a detailed inspection of areas otherwise impossible to access, such as the roof, cladding, and high-level windows. Our surveyors, who are also fully qualified drone pilots, are registered with the Civil Aviation Authority. This ensures compliance with the highest standards of safety, particularly in urban environments where airspace restrictions are prevalent. The drone survey captured high-resolution images and data of the relevant areas, allowing us to identify key issues that might otherwise have been missed. Specifically, we discovered significant defects in the roof and cladding, along with issues in the rainwater goods. Such findings are crucial as they hold the potential to save our client significant expenditure, mitigating risks that could escalate into costly repairs if left unaddressed. Our ability to integrate drone technology into traditional surveying practices not only elevates the thoroughness of our inspections but also adds substantial value to our clients by providing more comprehensive insights. This case in East London is a prime example of how leveraging innovative technology can lead to advantageous outcomes for our clients, ensuring their investments are sound, and their properties are maintained to the highest standard.

AAL chartered surveyors

2025-04-12 15:03:44 British local time

Navigating a terminal schedule of dilapidations, particularly when linked to a break clause, requires careful handling to protect tenant interests and limit liabilities. Our support typically include... Read more

Navigating a terminal schedule of dilapidations, particularly when linked to a break clause, requires careful handling to protect tenant interests and limit liabilities. Our support typically includes: 1. Review of Landlord’s Schedule: We carry out a line-by-line analysis of the landlord’s claim, identifying any overstated or unjustified items. 2. Preparation of Scott Schedule: Based on our review, we produce a structured counter-schedule, setting out what we consider fair and reasonable. 3. Negotiation: Using the Scott Schedule, we engage with the landlord’s surveyor to resolve discrepancies and reduce financial exposure. 4. Settlement: We work closely with your solicitor to conclude negotiations efficiently and in accordance with lease obligations. 5. Ongoing Advice: Post-settlement, we remain available to advise on the execution of agreed works. Our role throughout is to ensure that your position is robustly represented and your exposure is minimised. Please contact us if you are dealing with a terminal schedule. In most cases, we can achieve a material reduction in the claim.

AAL chartered surveyors

2025-04-12 14:57:52 British local time

Dilapidations Case in Great Portland Street Navigating the complexities of dilapidations claims can be challenging, which is why our expertise in dealing with such matters was pivotal in assisting a ... Read more

Dilapidations Case in Great Portland Street Navigating the complexities of dilapidations claims can be challenging, which is why our expertise in dealing with such matters was pivotal in assisting a tenant on Great Portland Street. When faced with a claim that appeared overstated, we stepped in to provide a comprehensive assessment and achieve a more balanced outcome. Our careful evaluation involved: - Reviewing the schedule of dilapidations to ensure accuracy and relevance. - Identifying discrepancies where items exceeded lease obligations or inaccurately represented the tenant's responsibility. - Scrutinising the cost methodology for items, paying particular attention to pricing basis, any potential betterment, and associated consequential works. Through our strategic negotiations with the landlord’s surveyor, we were able to secure a significant reduction in the claim, resulting in substantial cost savings for our client. This case exemplifies our commitment to safeguarding tenant interests while fostering constructive relations within the landlord-tenant dynamic. If you're facing a similar challenge, we're here to help you navigate it efficiently and effectively.

AAL chartered surveyors

2025-04-12 14:53:34 British local time

Acting for a Tenant: Dilapidations Success on Great Portland Street Cost-Saving Expertise When acting for our tenant client in this office dilapidations matter, we successfully navigated the claim o... Read more

Acting for a Tenant: Dilapidations Success on Great Portland Street Cost-Saving Expertise When acting for our tenant client in this office dilapidations matter, we successfully navigated the claim on behalf of our client to deliver a substantial cost saving. Through a careful review of the schedule of dilapidations and a negotiation with the landlord’s surveyor, we were able to reduce the original claim of approximately £44,000 to a far more manageable sum of £23,000. This result highlights the value of having a skilled and experienced RICS building surveyor on your side when faced with a terminal dilapidations schedule. If you’ve received a schedule of dilapidations, we encourage you to explore how we can assist. Visit www.aylingassociates.com/dilapidations-surveyor.html to learn more, or contact us directly for a no-obligation consultation.

AAL chartered surveyors

2025-04-12 14:48:32 British local time

Dilapidations Expertise at a Warehouse Unit in South East London We were pleased to assist our client in South East London by successfully negotiating a substantial cost saving on their dilapidations... Read more

Dilapidations Expertise at a Warehouse Unit in South East London We were pleased to assist our client in South East London by successfully negotiating a substantial cost saving on their dilapidations claim. Originally assessed at £88,000, our team’s negotiations brought this down to £70,000, resulting in a significant saving of approximately £18k. For tenants facing a schedule of dilapidations, this outcome demonstrates how effective negotiation can mitigate potential financial burden. Our thorough understanding of the process allows us the foresight to identify fair and achievable savings. If you find yourself in a similar situation, we encourage you to reach out for a complimentary consultation. Our professional team is ready to offer you insights and strategies tailored to your specific circumstance, striving for an outcome that works in your favour.

AAL chartered surveyors

2025-04-12 14:20:05 British local time

At our firm, we employ a rigorous and tech savvy approach to conducting commercial due diligence surveys, especially tailored for commercial properties. Our survey methodology integrates cutting-edge ... Read more

At our firm, we employ a rigorous and tech savvy approach to conducting commercial due diligence surveys, especially tailored for commercial properties. Our survey methodology integrates cutting-edge technology and systematic procedures to provide you with a comprehensive understanding of the property's condition. Key Features of Our Survey Methodology 1. Visual Inspection: Our surveyors conduct thorough visual inspections, utilising BuildSurvAI, our bespoke application. This tool streamlines the data gathering process, ensuring that nothing is overlooked and enhancing the accuracy of our findings. BuildSurvAI facilitates real-time data entry, which speeds up the generation of reports, enabling us to provide you with insights more swiftly. 2. Drone Survey: Acknowledging the challenges in accessing certain areas of industrial buildings, we deploy drone technology to inspect hard-to-reach areas such as roofs, high-level cladding panels, rainwater goods, and high-level windows. This not only increases the safety of our surveyors by reducing the need for physical access to high places but also provides a more detailed and comprehensive overview of the condition of these critical areas. Benefits of Our Approach - Efficiency and Accuracy: Our use of BuildSurvAI and drones cuts down on the time typically required for manual data collection and entry, allowing for more precise and quicker surveys. This means you can make informed decisions faster, crucial in the dynamic real estate markets of London. - Comprehensive Coverage: The combination of traditional surveying methods with advanced technology ensures that every part of the property is thoroughly assessed, leaving no stone unturned. - Safety and Accessibility: Drone surveys reduce the risk associated with physically accessing dangerous or difficult-to-reach areas, ensuring comprehensive coverage without compromising safety. - Enhanced Report Quality: Our technology-driven approach results in higher quality, detailed reports that provide a clearer picture of the property condition, aiding in the due diligence process. This strategic blend of technology and expertise underscores our commitment to delivering top-tier service and reliable information, helping you navigate your commercial property investments with confidence.

AAL chartered surveyors

2025-04-12 14:19:41 British local time

Navigating the complexities of a terminal schedule of dilapidations can be daunting, particularly when it intersects with the exercise of a break clause. For tenants, understanding your rights and obl... Read more

Navigating the complexities of a terminal schedule of dilapidations can be daunting, particularly when it intersects with the exercise of a break clause. For tenants, understanding your rights and obligations is crucial in managing both the legal and financial implications effectively. At AAL Chartered Surveyors, we specialise in providing expert advice and robust representation for tenants faced with dilapidation claims. A recent example of our work demonstrates the tangible impact of professional intervention. In this case, our client faced an initial dilapidations claim of circa £45,000. Throughour assessment and negotiation, we successfully reduced the claim to £26,000, achieving a cost saving of approximately £19,000 for our client. This outcome isn't just about financial relief; it's a testament to the importance of strategic planning and expertise in the field of building surveying. Our goal is to ensure that tenants are not only compliant with their lease terms but are also protected from excessive claims that can arise during key transition moments such as the exercise of a break clause. Understanding the details of your lease, the condition of the premises, and the specific terms of the dilapidations claim are vital steps in this process. Our team of accredited professionals works diligently to assess the validity and extent of claims, providing clear, actionable advice tailored to each unique situation. Should you find yourself in a similar situation, or if you are looking to better understand your position before such a scenario arises, our team is here to assist. By offering a tailored approach and striving for the most favorable outcomes, we empower our tenants to navigate dilapidations claims confidently and cost-effectively.

AAL chartered surveyors

2025-04-12 12:20:07 British local time

Commercial Due Diligence Survey: Industrial Unit, East London Building Pathology Aspects During our thorough investigation of the industrial unit located in East London, our chartered building survey... Read more

Commercial Due Diligence Survey: Industrial Unit, East London Building Pathology Aspects During our thorough investigation of the industrial unit located in East London, our chartered building surveyors identified critical issues related to building pathology which may impact both short-term functionality and dilapidations liability. Below we detail the key findings and recommendations: 1. Concrete Floor Slab Concerns: The survey revealed that the concrete floor slab is significantly out of level, with significant palpable variation throughout the space. The irregularity signals potential issues in the initial construction phase, including insufficient tamping, levelling, and concrete consolidation. Such conditions not only affect the operational efficiency of the space but might also lead to increased wear and tear, potentially escalating maintenance costs over time. We recommend a detailed structural assessment to ascertain the full extent of the issue and to evaluate remediation options. 2. Roof Panel Discrepancies: Our assessment identified the use of mismatched roof panels which are crucial for ensuring the water tightness of the structure. The intended interlocking mechanism of these panels has been compromised, with gaps between mismatched panels observed to be filled with mastic sealant. This is a significant concern as it poses a high risk of water ingress. We expressed to our client that roof leaks are probable during the lease term and noted that the roof could be deemed out of repair at the lease's commencement. Immediate corrective measures, including a professional reinstallation or replacement of the roof panels, are advised to safeguard the integrity of the building and maintain its value. These findings, while pointing to potential challenges, also provide a clear pathway towards enhancing the building's condition and operational viability. Addressing these issues promptly can help in safeguarding not only the physical asset but also the financial investment of our client. We at AAL Surveyors are prepared to offer our expertise in the evaluation of the suitability of a building for your business, and to advise of the pitfalls in relation to the physical condition of the property. For further details, professional consultation, or to discuss next steps, please do not hesitate to reach out to our team. We are here to assist with all your commercial property needs.

AAL chartered surveyors

2025-04-12 11:20:05 British local time

Reinstatement Cost Assessment for Insurance Purposes at a Prestigious Central London Listed Building for an Academic Institution Building Type and Use: Our recent project involved performing a detail... Read more

Reinstatement Cost Assessment for Insurance Purposes at a Prestigious Central London Listed Building for an Academic Institution Building Type and Use: Our recent project involved performing a detailed Reinstatement Cost Assessment (RCA) for a distinguished academic institution, housed within a listed building in the heart of London. Understanding the operational importance of the institution and the historical significance of the premises, the challenge was to conduct a thorough evaluation without hindering the day-to-day activities of the occupants. At AAL Surveyors, we prioritize our client's convenience and operational continuity. For this project, our team meticulously planned the survey process in close coordination with the institution's management. This ensured our fieldwork was seamlessly integrated into periods of lesser activity, thereby mitigating any potential disruption. The RCA was performed, taking into consideration the unique architectural elements and heritage constraints inherent to listed buildings in Central London. Our assessments are not only about determining the cost of reinstating the building in the case of significant damage or loss but also about ensuring compliance with the stringent regulations governing listed properties. Our proactive communication strategy and adaptive scheduling allowed us to provide a comprehensive report that supports the institution in making informed insurance decisions. This report is vital for safeguarding the architectural integrity and operational capabilities of the building, ensuring that the institution is adequately covered without being over-insured. At AAL Surveyors, our expertise in handling sensitive and complex environments, such as listed academic buildings, sets us apart. We deliver tailor-made solutions that respect the historical value and operational needs of every unique property we work with. If you require a nuanced and meticulously executed Reinstatement Cost Assessment, our team at AAL Surveyors is equipped to exceed your expectations with industry-leading precision and care.